Losing a job can be a stressful and uncertain time, but applying for unemployment benefits can provide the financial cushion you need while you search for new work. However, the application process is often misunderstood, and many applicants are unsure how to navigate it. In this comprehensive guide, we will break down every detail, from eligibility to how to apply and what to expect after submitting your claim.

What is Unemployment Insurance?

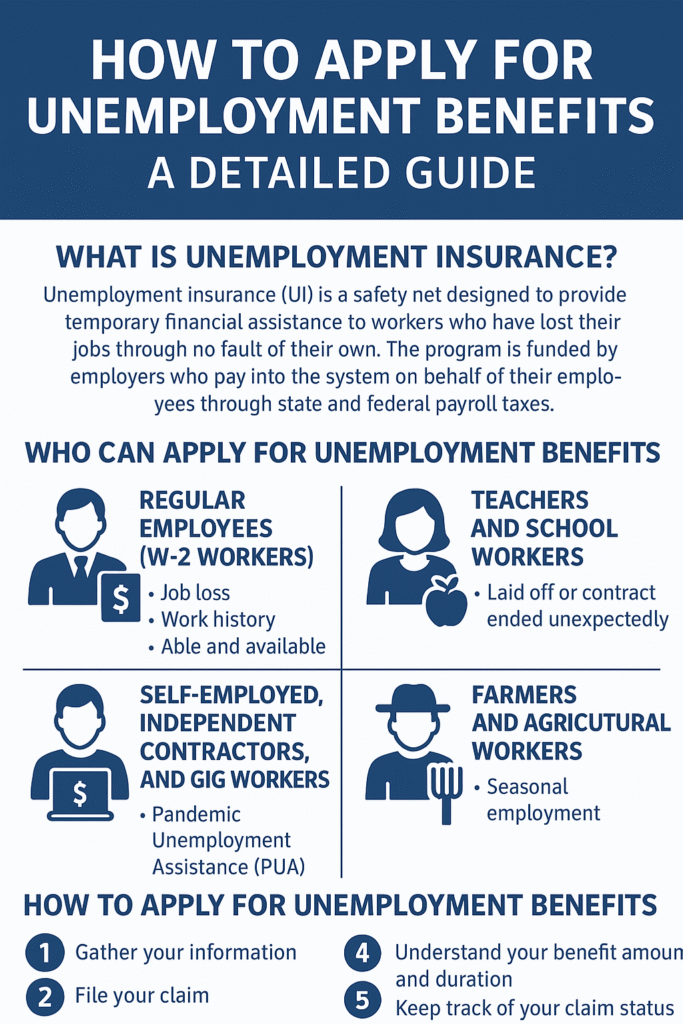

Unemployment Insurance (UI) is a safety net designed to provide temporary financial assistance to workers who have lost their jobs through no fault of their own. The program is funded by employers who pay into the system on behalf of their employees through state and federal payroll taxes. The amount of benefits and the duration of unemployment assistance vary based on your previous earnings, state regulations, and other factors.

Key Features of Unemployment Insurance:

Temporary Assistance: UI benefits are not meant to be a long-term solution but rather a temporary assistance until you find new employment.

Eligibility Criteria: Eligibility is usually tied to having earned a minimum amount of wages during a certain period and losing your job due to reasons beyond your control.

State-Specific: Each state administers its own unemployment insurance program, which means eligibility requirements, benefit amounts, and application procedures vary.

Who Can Apply for Unemployment Benefits?

While most workers are eligible for unemployment, there are several specific groups whose eligibility may differ. Here are the key categories:

1. Regular Employees (W-2 Workers)

If you were employed as a regular worker and have lost your job, you are most likely eligible for unemployment benefits. The essential eligibility requirements for W-2 employees generally include:

Job Loss: You must have lost your job through no fault of your own (e.g., you were laid off or furloughed).

Work History: You need to have worked a sufficient amount of time (or earned enough wages) to qualify. Each state sets its own requirements. For example, some states require you to have worked in at least two of the last four quarters before filing a claim.

Able and Available to Work: You must be actively seeking employment and able to work. If you are physically unable to work or choose not to look for a job, you may not qualify for benefits.

2. Teachers and School Workers

Teachers, educators, and school workers face a unique situation when it comes to unemployment benefits. During periods between school terms (like the summer break), these workers generally do not qualify for unemployment because they have an “expectation” of returning to work in the next school year.

However, there are exceptions:

Laid Off or Contract Ended Unexpectedly: If your school contract ends earlier than expected or you are laid off unexpectedly, you may qualify for unemployment benefits.

Special Circumstances: During times of economic hardship (such as the COVID-19 pandemic), many states have temporarily expanded benefits for school workers affected by closures or staffing cuts.

3. Self-Employed, Independent Contractors, and Gig Workers

Historically, independent contractors, gig workers, freelancers, and self-employed individuals were not eligible for unemployment benefits. However, during the COVID-19 pandemic, the federal government introduced Pandemic Unemployment Assistance (PUA) to extend unemployment benefits to workers in these categories.

What Changed for Gig Workers?

The CARES Act temporarily made gig workers, freelancers, and self-employed people eligible for benefits through PUA. This included workers in industries such as ride-sharing, food delivery, and contract work.

What’s the Situation Now?

While PUA has expired, some states have begun to offer limited assistance for these workers through state-funded programs. It’s important to check your state’s unemployment website for specific information about whether any ongoing benefits exist for gig workers.

4. Farmers and Agricultural Workers

Farm workers have their own set of rules regarding unemployment benefits. Generally, workers employed in agricultural labor may qualify for unemployment insurance benefits if they meet specific eligibility requirements.

Farm Workers and Seasonal Employment: If you work on a seasonal basis and lose your job between growing seasons, you may qualify for unemployment benefits, provided you meet the work history and earnings requirements set by your state.

5. Part-Time Workers

Part-time workers can qualify for unemployment benefits as long as they meet the basic eligibility criteria. This includes losing their job through no fault of their own and meeting the state’s earnings threshold. However, the amount of benefits you receive may be lower compared to full-time workers since your previous wages were lower.

How to Apply for Unemployment Benefits: A Step-by-Step Process

The process of applying for unemployment benefits may seem daunting, but breaking it down into smaller steps can make it more manageable. Here’s a detailed, step-by-step guide on how to apply for unemployment benefits:

Step 1: Gather Your Information

Before you begin the application process, make sure you have all the necessary information on hand:

Personal Information: Your name, address, phone number, and Social Security number.

Employment History: The names, addresses, and phone numbers of your previous employers within the last 18 months, along with your dates of employment.

Income Information: Records of your wages or other proof of income, such as pay stubs or tax returns.

Reason for Unemployment: Be ready to explain the reason for your unemployment, such as being laid off, furloughed, or unable to work due to illness or personal reasons.

Step 2: File Your Claim

Most states allow you to file an unemployment claim online, but some may offer alternative methods such as phone applications or in-person filing.

Online Application: Visit your state’s unemployment website and navigate to the section for filing a new claim. Follow the prompts and complete the necessary forms. Some states may require you to create an account before applying.

Phone or In-Person Filing: If your state doesn’t have an online application or if you prefer to speak with a representative, you can apply via phone or schedule an in-person appointment.

Step 3: Certify for Weekly Benefits

Once your claim is approved, you will need to certify for weekly benefits to receive payments. This process involves answering a set of questions each week (or bi-weekly) to confirm that you are still unemployed and actively seeking work.

What is Certification? Certification is a process where you report your job search activities, confirm that you are available to work, and update your claim status. This step is critical for receiving continued unemployment payments.

What Happens if You Miss a Week of Certification? Missing a certification week may result in a delay or denial of benefits for that week, so make sure to stay on top of this requirement.

Step 4: Understand Your Benefit Amount and Duration

The amount of unemployment benefits you will receive depends on several factors, including:

Your Earnings History: States calculate your benefit based on your earnings during a specific period (usually the past 18 months).

State-Specific Benefit Amounts: Each state has a maximum weekly benefit amount (WBA). The WBA is typically a percentage of your earnings during your highest-earning quarter.

Duration of Benefits: Most states offer up to 26 weeks of unemployment benefits, though the duration may be longer during times of high unemployment or economic crises (e.g., extended benefits in response to recessions).

Step 5: Keep Track of Your Claim Status

After submitting your claim, you’ll receive a notice outlining whether you’re eligible and the amount of benefits you will receive. If you’re denied benefits, you can appeal the decision. Keep track of your claim’s status online or through your state’s unemployment office.

Common Questions and Answers

1. How Long Can I Receive Unemployment Benefits?

Most states allow up to 26 weeks of unemployment benefits, though the duration may be extended under specific circumstances, such as during high unemployment periods.

2. How Much Will I Receive in Unemployment?

The benefit amount is typically calculated based on a percentage of your highest-earning quarter over the last 12-18 months, with a state-set maximum amount.

3. Can I Work While Receiving Unemployment Benefits?

Yes, many states allow you to earn some income while receiving unemployment benefits, but the amount you earn may reduce your weekly benefit amount. If you make too much, you may become ineligible for benefits.

4. What Happens If I Am Denied Benefits?

If you are denied unemployment benefits, you can file an appeal. Each state has a process for contesting a denial, including timelines for submitting your appeal.

Final Thoughts

Applying for unemployment benefits can provide much-needed support during a period of job loss or economic hardship. By understanding the steps involved, knowing who qualifies, and staying informed about your state’s specific rules, you can navigate the system more confidently.

While each state has its own system, the general process remains largely the same across the country. Make sure to stay proactive and keep your information up to date with the unemployment office to avoid delays. Unemployment benefits are there to support you as you transition to new work, so don’t hesitate to apply and take advantage of the resources available.

y